Bank of America has been mailing to its credit card customers about a 5% cash back offer this holidays. The categories are pretty broad and includes stores that sell Books, Toys, Electronics, Sporting goods and Department stores.

For more clarification, the codes are as follows:

The above MCC codes are helpful since you can ask the cashier about the code to which your card would be billed to and get your card eligible for some discounts.

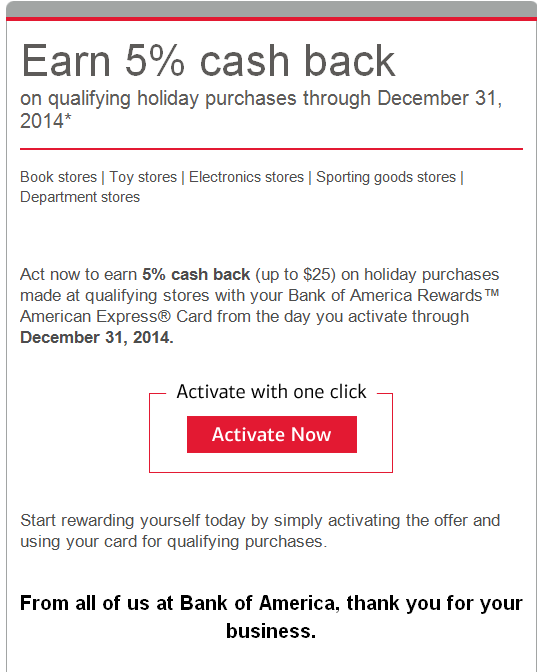

The email is along the following line and read the fine print carefully. From what it seems, multiple cards could be eligible for this promotion. Since the category of stores are so wide and almost anyone buying a gift will have a high probability of visiting one of these stores it is free 5% cash back on top of the promotions that most stores are running during the holiday season. There is nothing in the fine print related to gift card purchases. So I plan to stock up gift cards and then use them at a later point of time.

The original activation email:

There is a $25 limit on each card, which means a purchase limit of $500. Since the average Thanksgiving/Holiday season gifts fall in this range, this offer is applicable for the vast majority of users. There is no other bonus category card across the board, including Chase and Discover or Citi, that have the 5% on such a broad range. Discover has 5% cash back for online purchases.. same as Chase Freedom which has similar offer for Amazon purchases. So in all, this card from Bank of America stands out as a real winner. I have this card and it is pretty versatile in terms of design and usage. Usually, Bank of America is not the first bank that springs to mind when it comes to big bonus rewards or category rewards. But this holiday season, Bank of America seems to have really done well with this program. There is quite a bit of Twitter and social media buzz around this campaign and good user adoption would mean more such programs in future.