So to all the dear readers who read this blog, Happy Holidays from the Honey Badger world!

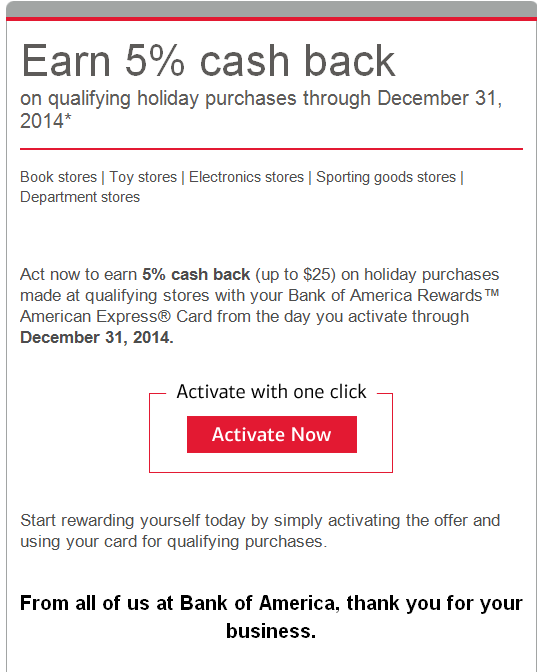

We have not been posting a lot these days. There is not much traction in terms of good offers and the holidays were a big let down in terms of good offers. If anything, there were some negative news which I did not want to post here and spread the gloom around. The Amex Small Business Saturday was there as usual. And so were many other typical holiday offers like free gift card shipping and no fees. US Airways is running a limited time promotion for those who fly US Air - 50,000 points instead of the regular 40,000 points found on their website. There is an annual fee but the points are worth more than that. Southwest and United are on with their usual offers. So is British Airways. All these have been covered in the past posts. Many spending programs are bringing their axes down so Vanilla Reload is being discontinued. The PayPal program, which was not much to begin with, is also doing some belt-tightening as it is being hived off into a different entity or a separate company. Oh well, enough with this gloom and doom. On the plus side, this means more and more offers are being lined up in the cut throat competitive credit card world. There is a sign of credit criteria being eased by many banks. Most likely, we will see better offers in the first quarter as the targets have to be met by the banks.

In any case, this is the time of the year when it is good to lay off the credit card for a while and focus on good stuff like the travel and fun. After all, we are doing this just for the memories!