Is there any limit on the number of credit cards or any cards by Bank? Officially, many banks do not have any explicit policies related to this. Some banks do mention that they are not interested in more than x amount of cards. For instance, I have seen with Capital One and Barclays that they would not approve a third card unless your existing two cards have ample history with them. Some banks go with credit line usage rather than number of cards so they would allot a credit of say $5000 per customer and as long as you are under that limit, you could have 5 cards with $1000 on each. American Express is one of those banks. They deny that there is any limit on the number of cards allotted. They do accept that each customer has his account reviewed periodically and the credit line adjusted. This means they go thru your account history and determine if you need or might use more credit and just up the limit on these cards. Most banks such as Chase or Amex accept transfer credit line requests to another card. With chase, this is breeze. You could email them and voila, it is all set. With Amex and the rest, you have to submit a request and they sometimes make another inquiry into your credit history.

In Flyer talk forums, the Amex gets it limit as 4 - including both personal and business credit cards but excluding the charge cards. Most Amex charge cards are easy to get and they approve immediately but the main difference between charge card and credit card is that the former has been paid in full at the end of billing cycle while the latter, in theory, could be carried over. Of course, carrying balance over to next billing cycle is detrimental to your finance and should be done only if you are getting a 0% APR.

So in a nutshell, Amex has a 4 or 5 card limit depending on income, spending history, your cumulative card limit vs approved credit line among others.

For Chase, there appears no such limit. There are multiple cards that have been approved by Chase. Some daring FT folks claim they have almost all credit cards issued by Chase at one point or the other. I for one, am pretty close to that stage myself.

Barclays seem to have a hard limit of approximately 3. Anything more than that and you are given the dreaded "Your application is under review" page.

Capital One seems to have a hard limit of around 4. They are very region and market specific. So while there are reports to have gotten up to 4 cards if you are in Mid-Atlantic region, north-east users seem to have difficulty in even getting one approved. They seem to have a limit of one or two for west and down south. Which is understandable given they have limited footprint in those areas.

Most credit unions, smaller banks limit you to one or maximum two.

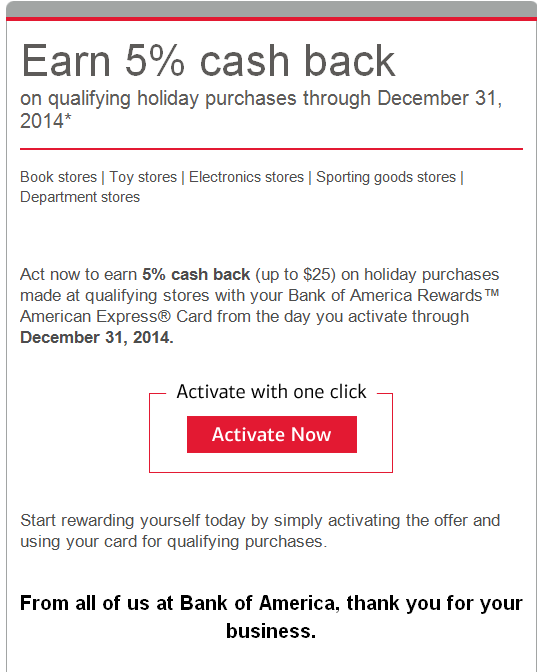

Bank of America, being a big one, seems to not have such limits. There are instances of 5 or 7 credit cards being approved. In general, Bank of America is also the most lenient - that is the consensus.

PNC/Principal/Citizens/Citadel - all seem to have a limit of about 2.

US Bank has about 3 as the maximum number. There are consistent reports where they ask you why you need so many credit cards. Which is ironic given they issue so many partner and co-branded credit cards.

The big bank, Citi, also has a hard limit of about 3. They were pretty generous once upon a time and I have had more than that at one point. But they have cracked down heavily and are issuing way less credit cards than in the past. They are also notorious to randomly close the accounts. So even if you are having multiple cards, I would tread this one with caution. Also, in terms of sign up rewards or redeemable points, both Citi and Bank of America are not really the cream. Though they do have pretty good daily usage cards or simple credit cards which are flexible with not much hassles.

Will cover more banks in future as they come.